Subscription Required

To get access to this video, and more than 1000 like it Subscribe Online today!

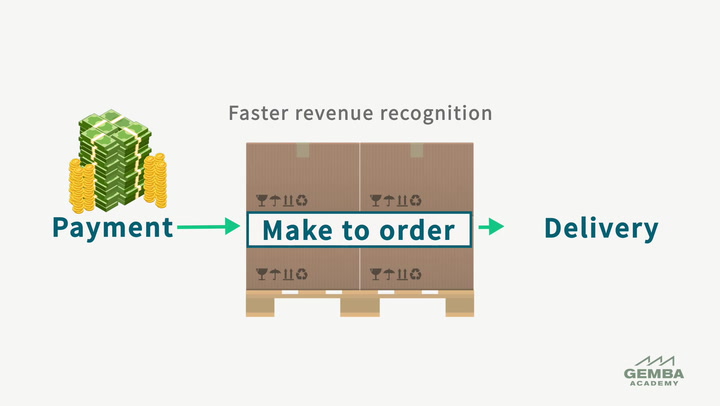

Make-to-stock, Make-to-order, And Deferred Revenue Recognition

During a lean transformation, many operations shift from make-to-stock to make-to-order. In some cases, this can result in deferred revenue recognition. Learn why it’s important to understand how this happens, as well as what it means for financial reporting and the balance sheet.

Course Videos

Getting Started with Lean Finance

09:16

2How Continuous Improvement Helps the P&L

03:41

3How Continuous Improvement Reduces COGS

03:15

4How Continuous Improvement Reduces Inventory Carrying Costs

02:59

5How to Calculate Soft Savings

08:06

6How Lean Can Make a Company's P&L Look Worse

03:26

7Why Don't We See Financial Results from Our Improvements?

05:32

8What Is Absorption Costing?

02:15

9Why Move Away from Absorption Costing?

03:03

10How to Start Moving Away from Absorption Costing

04:21

11Direct Costing vs. Value Stream Costing

02:37

Current Video

Make-to-stock, Make-to-order, And Deferred Revenue Recognition

03:02

Next VideoLean Budgeting and Forecasting

06:04

14How to Improve the System as a Whole

03:02